Accounts payable is capital owed by an enterprise to its suppliers displayed as a liability on the organization’s balance sheet. These are obligations of a company to pay off in a short time to its suppliers or creditors. It also is known as the division or department of an organization that pays bills to suppliers or creditors. These amounts are paid to suppliers or vendors for services or goods received by these suppliers.

The sum of all these amounts is displayed on the company balance sheet as accounts payable balance. The cash flow statement will show the decrease or increase in total accounts payable for a specific period. Management can pay its outstanding bills before due dates to improve its cash flow. Larger businesses have a specific department to manage accounts payable and travel expenses.

However, some organizations do not waste money for highering new staff to manage the AP department. These organizations get the help of some online websites to solve AP problems. These applications create balance sheets automatically to show the details of accounts payable and the performance of the business based on the cash flow.

What are Accounts Payable Software?

Accounts Payable Software are specific applications designed to manage accounts payable and some other management targets. Accounts payable software works as a accounts payable department of a company to handle all sales and purchase targets. You can create customized invoices according to your company logos. SSL encryption and other security measurements are present in these applications to provide a secure environment. In some of the apps, you can share files like images, documents, voice messages, and videos to your colleagues or partners.

Besides, you can use a chat room to chat with your clients or suppliers. The managers can work as admins to access specific roles and permissions to their users and clients on dashboards. Work with these applications for cost management, inventory management, budget management, and purchase order management. These applications offer real-time analytical reports to check the performance of your business and make decisions according to these reports.

Best Accounts Payable Software

Here is the list of Best Accounts Payable Software that are providing services online.

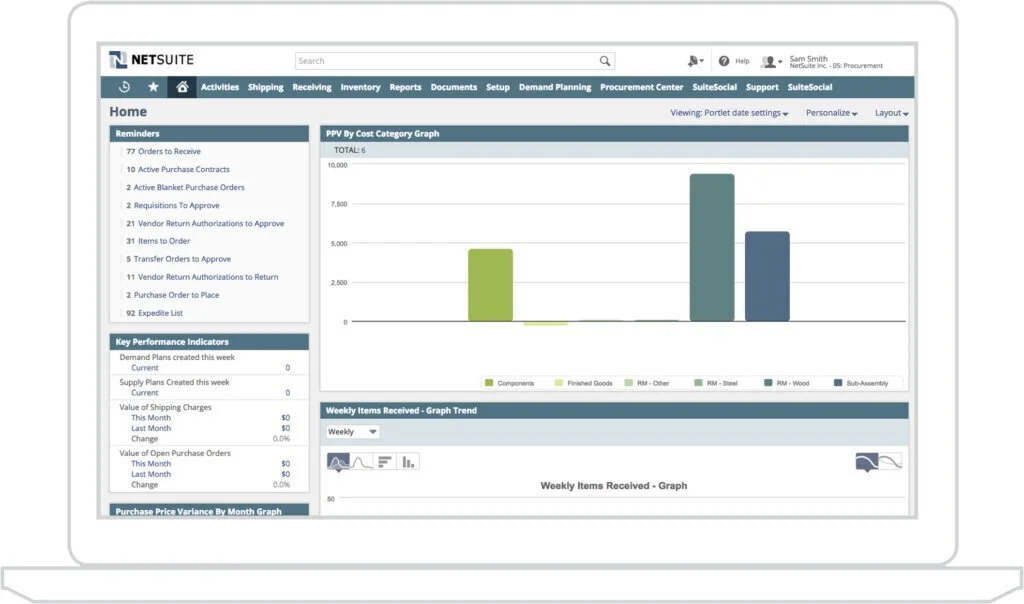

1. NetSuite

NetSuite is a scalable and complete cloud ERP platform designed for high-growing large businesses. It can perform back and front office tasks automatically, such as revenue management, order management, financial management, inventory management, and billing. It offers a customizable view of reports and performance indicators for all clerical staff and top management of the organization. It combines built-in business intelligence and financial management tasks to make well informed and data-driven decisions.

A robust order management suite is there to boost order-to-cash jobs. Product management features assist you in getting production workflows. Warehouse administration is there to manage end-to-end inventory and updates data regularly. It manages inbound and outbound logistics to reduce the cost of ownership. Work with HCM features to accurately perform procure-to-pay tasks. Record formats and detailed transaction forms are part of it for accounting staff to perform tasks.

You can create invoices, submit purchase orders, and pay bills instantly. Besides, you can manage documents, maintain records, generate reports, and track time and expenses. Real-time dashboards allow you to track performance indicators and analyze the system data. You can configure customizable screen layouts according to your company roles. Monitor your business’s health and convert numerical data into visual analytics. Additionally, make custom data summaries and get a variety of reports.

Features

- Tax management

- Workflow management

- Financial reports

- Asset Roll forward

- Depreciation management

- Payment processing

- Payment acceptance

Pros

- Cost management

- Inventory control

- Product costing

- Fulfillment and shipping

- Payroll services

- Revenue management

Cons

- Moderate learning curve

- For large business only

Pricing

- Quote-based Plan: Contact the Vendor

Visit: NetSuite

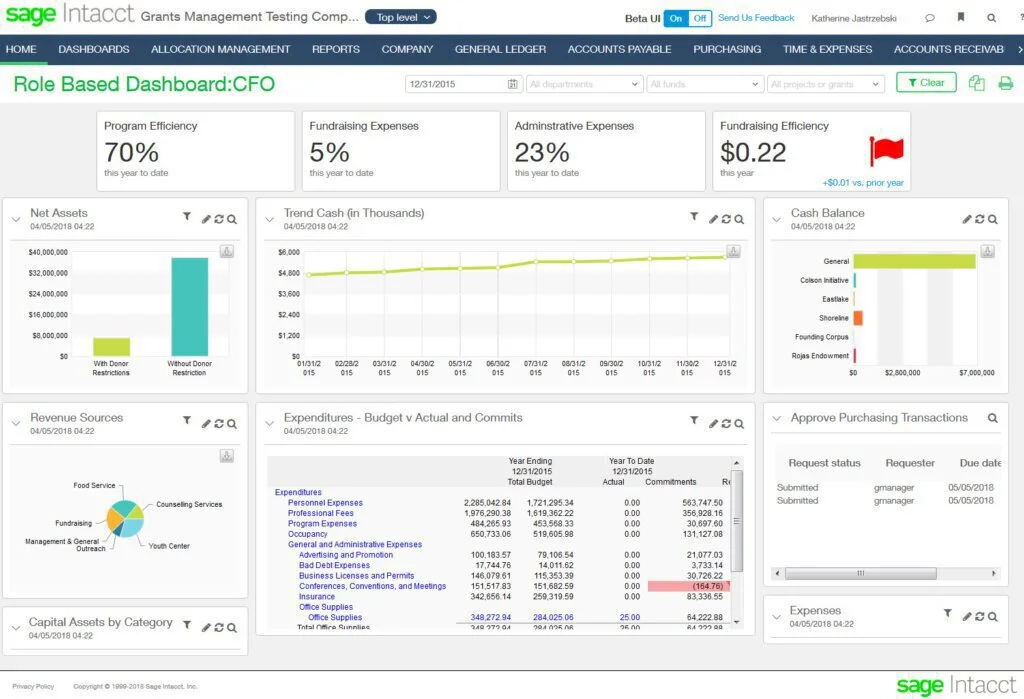

2. Sage Intacct

Sage Intacct is a cloud financial management tool that offers the best capabilities. Growing companies work with Sage Intacct to improve efficiency and drive business growth. Admins can provide limited access controls to users. The customizable dashboard allows you to make shortcuts of standard functions. Apply multiple features and get different viewing options for boosting your tasks. The program can handle tasks regarding bills and credit cards.

It offers a secure platform and streamlines the processes for online services and purchases. E-commerce can work it to perform faster. You can customize purchase orders by using multiple standard templates to suit the structure of a broad range of organizations. The program includes many dashboards, charts, and dashboards related to necessary financial reports. You can set and customize calculations for commissions. Managers can monitor payment transactions to make the task more transparent.

Work with a payment gateway to push credit card payments through PayPal. It implements multiple security tools like control access to individuals, roles, projects, and groups. Work with the balance sheet to track sales and analyze performance. Work with built-in report templates for reporting according to requirements of a presentation. Multicurrency management tools are helpful for small scale transactions, complex international transactions, and vendor management.

Features

- Accounts payable

- Accounts receivable

- Multiple currency support

- Inventory management

- Activity statements

- Sales tax

- Journal entries

- Bank reconciliation

- Trial balance

Pros

- Viewing options

- Reporting templates

- Customize purchase orders

- Auto-tax calculator

- 1099 support

Cons

- Clunky

- Not userfriendly

Pricing

- Trial: Free

- Quote-based Plan: Contact vendor

Visit: Sage Intacct

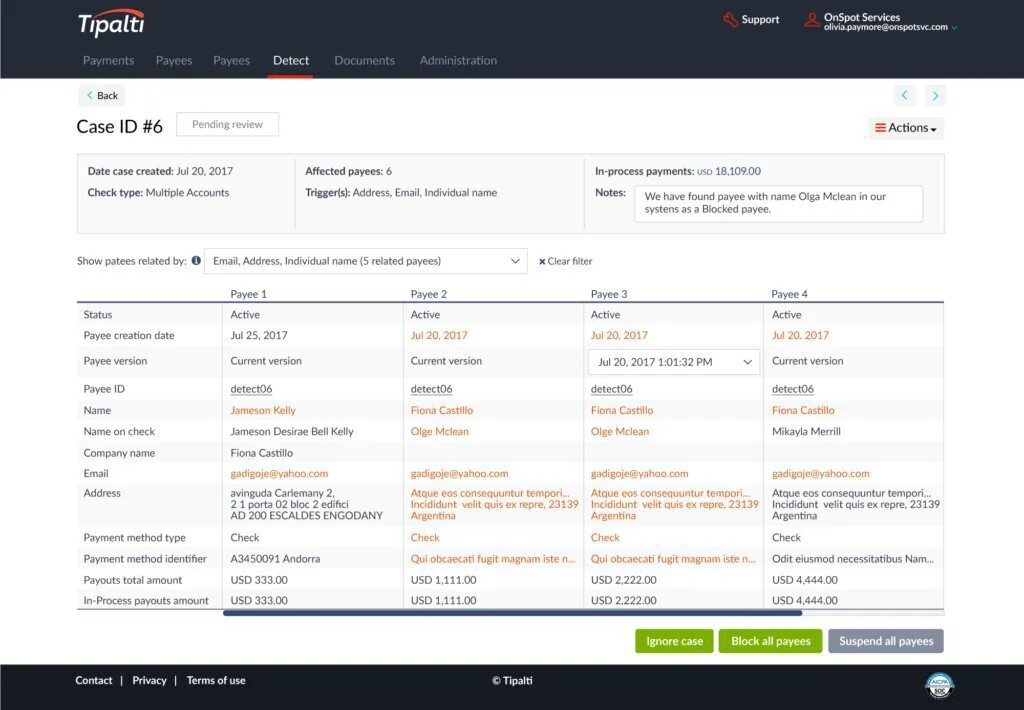

3. Tipalti

Tipalti is an award-winning management and payment automation application to impress customers. Its payment reporting system can make detailed payment reports automatically, taking in mind regional consideration, payment method strategies, and taxation rules. You can pay in 120 currencies and use six payment methods like US ACH, Paypal, Global ACH, Prepaid Debit Card, Wire, and Local bank transfer.

It will provide financial reports regarding signatory rights, advanced payment reconciliation, edit rights, audit trails, and payment threshold settings. It has compliance with International and National taxation standards to prevent payment issues. It will help in making 1042 tax reports, preparing forms quickly, and empowering self-billing. Tipalti performs all tasks on the supplier management portal allowing suppliers to insert and manage taxation details.

So it provides supplier control and eliminates human errors and downstream problems. This platform performs all manual and global pay-out tasks automatically. Nowadays, Tipalti is a primary leader in AP, payment reconciliation, and financial reporting. It has integration with network performance tracking and affiliate program management. It automates vendor and customer payment tasks and affiliate payments processing.

Features

- Supplier management

- 1042-S tax reports

- Tax from compliance

- Paypal payment processing

- Payment risk management

- Payment reconciliation

Pros

- Payment fraud detection

- Currency selection

- Global payment processing

- Program management integration

- 1099 form generation

- Secure payment

Cons

- Little antiquated

- Need more customization

Pricing

- Quote-based Plan: Contact vendor

Visit: Tipalti

4. AvidXchange

AvidXchange is a trusted bill payment and accounts payable solution that is solving tasks for more than 5,000 companies. A highly configurable interface and a full suite of tools make it useful for banks, small businesses, and large enterprises. Specialists are behind the application to give reliable support to your IT professionals. Backup procedures and secure SSAE 16 facilities are security features of this cloud-based application.

The program eliminates paper invoices and checks and changes the way of your company by switching your billing tasks to an advanced paperless process. It eliminates time-consuming and repetitive tasks and streamlines AP and payment procedures automatically. This scalable and productive tool streamline multiple tasks such as manual data entry, fielding inquiry calls works, search for misplaces invoices, viewing and sorting invoices, as well as waiting for the overnight courier to get approvals.

Work with electronic data to complete audit trails and reduce audit costs. You can minimize invoice approval timeframe to get early payment discounts. It can perform invoice approval, capture, and payment tasks automatically. Work with payment and AP automation to reduce manual jobs related to checks and invoices.

Features

- Purchase order application

- Invoice application

- Payment application

- Pay services

- Billing services

- Invoice accelerator

- Supplier portal

Pros

- Cash management

- General ledger

- Cash management

- Accounts payable

- Accounts receivable

- Bank reconciliation

Cons

- Managing relationships is challenging

Pricing

- Quote-base Plan: Contact the vendor

Visit: AvidXchange

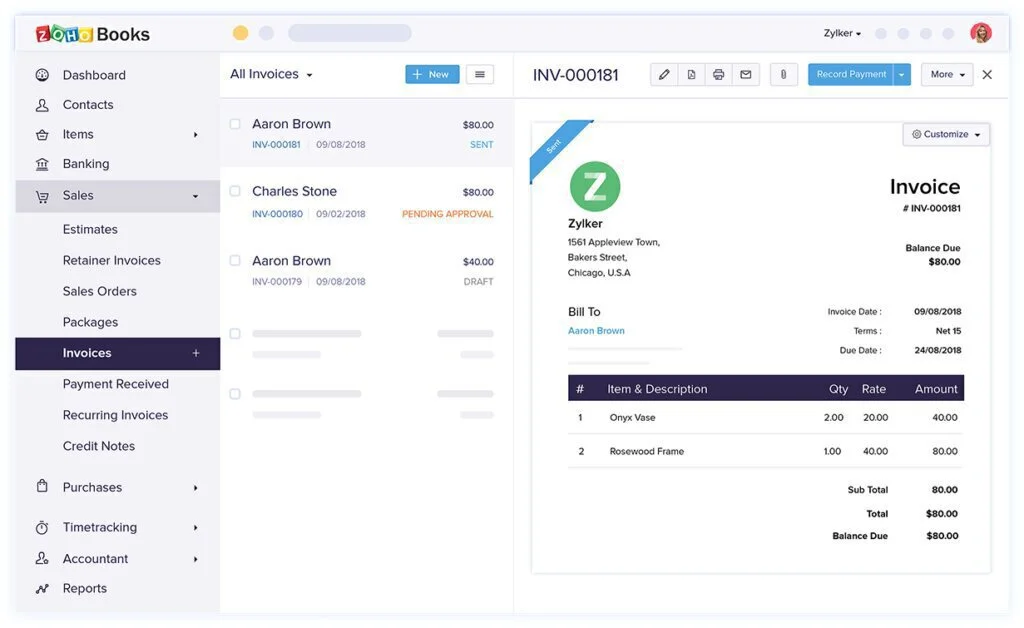

5. Zoho Books

Zoho Books is an account payable automation software created for growing businesses. This simple application facilitates you to make data-based, intelligent decisions. Over 13 million users over the world are working with Zoho to perform their business tasks. This application has integration with Zoho apps to solve many accounting challenges. The program eliminates data entry, allowing you to insert all credit card and bank transactions and categorize them instantly.

You can send personalized texts to customers to pay bills on time and schedule frequency in a suitable manner. Work with collaboration features and allow users to access invoices and estimates and make payments using the online client portal. Besides, clients can decline/accept estimates and comments on them. You have the choice to get invoices for each estimate, run detailed reports on all payments, and record offline payments.

For any type of project, you can log in and insert the time of its completion, and it will record the expenses on it for clients’ invoices. It has the integration with Zoho CRM to access product pricing details, make new orders, and get credit statuses from your clients. Inventory management is also a useful tool to control stocks and orders in real-time. You can create and send a purchase order instantly and make inventory reports automatically. It offers dedicated apps for your Mac, Windows, Android, and iOS devices to make your work more comfortable.

Features

- Contact management

- Time tracking

- Online payments

- Invoices

- Inventory management

- Invoice templates

Pros

- Expenses

- Automatic bank feeds

- Purchase order

- Mobile apps

- Reports

- Accounting

- Sales order

Cons

- No payroll

Pricing

- Trial: Free

- Basic: $9/organization/month

- Standard: $19/organization/month

- Professional: $29/organization/month

Visit: Zoho Books

6. Xero

Xero is a beautiful financial collaboration application in the accounting category. It is useful to fulfill the needs of small businesses to manage their financial events. It can adjust taxes of over 20 states automatically and runs payrolls. The application works as a powerhouse for stock and inventory management. Work with payroll performer to make and save possession records and use them in your transactions automatically.

All these records include details like committed quotes, purchase costs, tax status, and related descriptions. It offers standard reports such as income statements, cash flow records, and balance sheets. The additional analysis provides highly specific reports regarding expenses per contacts, sales per article, and aged payables. A Business Performance tool can track net value per sale and equity ratio debts. Work with management reports to get a full view of the business’s profitability.

You can edit all purchase files by using ready templates. Open the template, check or uncheck data fields and create documents of your requirements. Two-factor authentication and multiple-approval model are there for transactions, which reduces the possibility of financial fraud. Regarding sales, you can manage purchase orders and categorize invoices as awaited payment, awaited approval, drafted, or delayed. From the dashboard, monitor invoicing and billing status and make a comparison of finances in readable charts.

Features

- Dashboard

- Expense claims

- Track customers and suppliers

- Bank reconciliation

- Financial reports

- Inventory

- Email support

Pros

- Fixed assets

- GST returns

- Purchase orders

- Payroll

- Multi-currency

- Online accounting

- Mobile apps

Cons

- Poor customer service

- Not intuitive

Pricing

- Trial: Free

- Starter: $9/month

- Standard: $30/month

- Premium 10: $70/month

Visit: Xero

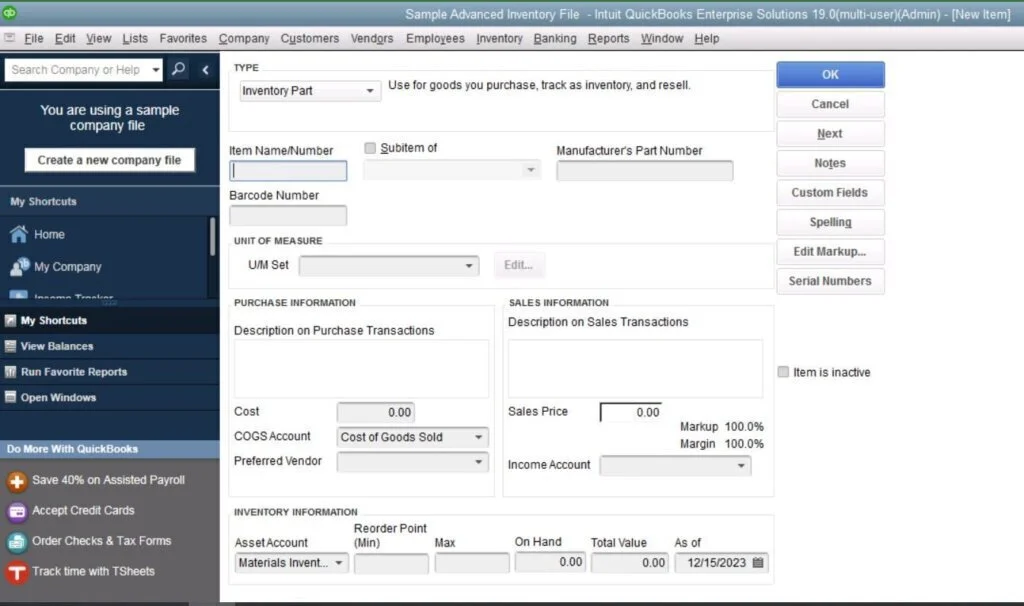

7. QuickBooks Enterprise

QuickBooks Enterprise is an online financial service application that provides accounting solutions for non-profit organizations and growing businesses. It is a dedicated accounting platform to perform tasks like inventory tracking, payrolls, and payables. The program can create custom reports and professional financial statements. Besides, it can export your data to an existing or new Excel spreadsheet. Work collections center to identify due and overdue email collection notices and invoices instantly.

You can import credit card and bank transactions to its dashboard as well as enable it to pay bills and track expenses automatically. Advanced inventory feature allows you to accurate data entry using serial numbers and scanning inventory. It can take snapshots of unlimited on-hand articles, purchase orders, sale orders, and re-orders. It can make industry-standard reports according to your business requirements. Using the stock status report, check inventory requirements.

It offers built-in legal documentation and compliance tips to solve employment issues like compensation, hiring, recruiting, employee relations, termination, and benefits. Besides, you can insert multiple vendors and make custom fields to get unique information. Work with the central access feature to make user-profiles and provide access to your team members from a single screen. Create Bills of Materials to track inventory and costs as well as put useful inventory data on a single screen.

Features

- Bin Location tracking

- Advanced inventory

- Payroll

- Accountant center

- Industry functionality

- Multi-location inventory

- Barcode scanning

- File manager

Pros

- Work orders

- Mobile payment and billing

- Advanced pricing

- Employees and Payroll

- Sales and customers

- Automatic inventory

- Cons

- For large businesses

- Expensive cost

Pricing

- Trial: Free

- Silver Plan (With Hosting): $140/month

- Gold Plan (With Hosting): $169/month

- Platinum Plan (With Hosting): $198/month

- Silver Plan (Local Only): $1155/year

- Gold Plan (Local Only): $1502/year

- Platinum Plan (Local Only): $1848/year

Visit: QuickBooks Enterprise

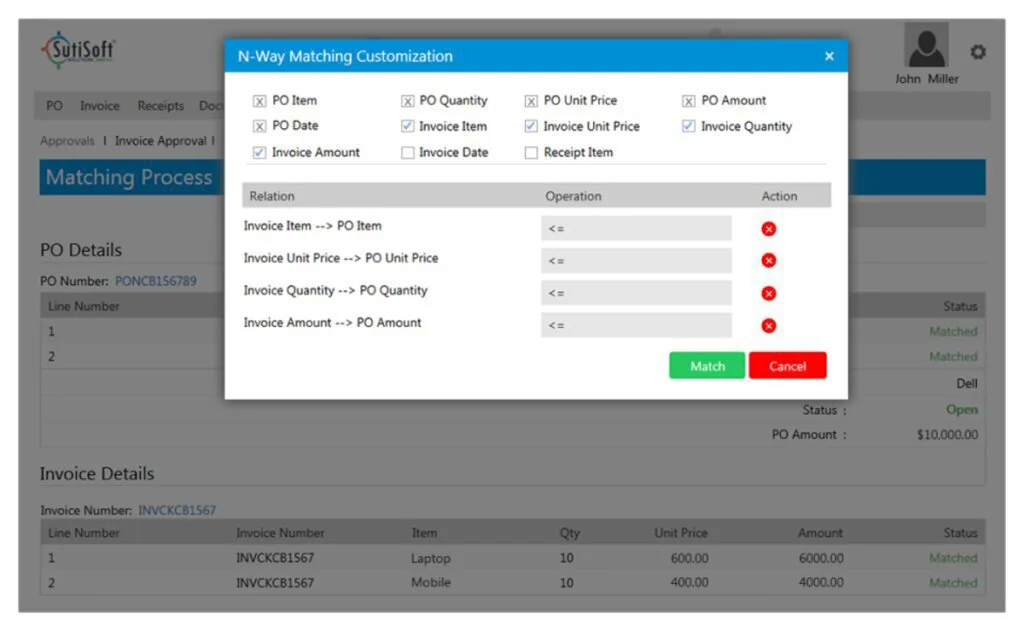

8. SutiAP

SutiAP is an accounts payable program to manage your workflow related settlements of invoices. This workflow might be submission, collection, payment, and approval of invoices. It has a smooth integration with famous accounting solutions to provide the flexibility to your financial tasks like spend management, auditing, and cash management. It includes multi-format and multi-language invoice support for International offices.

Robust analytics assists companies to manage their expenses and assets and make better decisions and get their targets. The program will facilitate you to make better partnerships and get some better deals. This cloud-based solution stops companies for duplicate payments and helps them to be familiar with current and existing policies. It will accelerate the settlement and management of all tasks regarding accounts payable.

Companies can work with it to manage and review the invoices of the suppliers. Multilevel payment approval assists the management in deciding who can approve the payments. It will simplify your cash management tasks and provide you better control over payment actions. You can make a fruitful and healthy relationship with suppliers using accurate information.

Features

- Multi-channel capture

- Duplicate verifications

- Cost center allocation

- Support multiple languages

- Attach documents

- Email notifications

- Hierarchy approval

- Payment approval

Pros

- Analytics and reports

- Supplier portal

- Payment history

- Integration with the accounting system

Cons

- Minor glitches

Pricing

- Quote-based Plan: Contact vendor

Visit: SutiAP

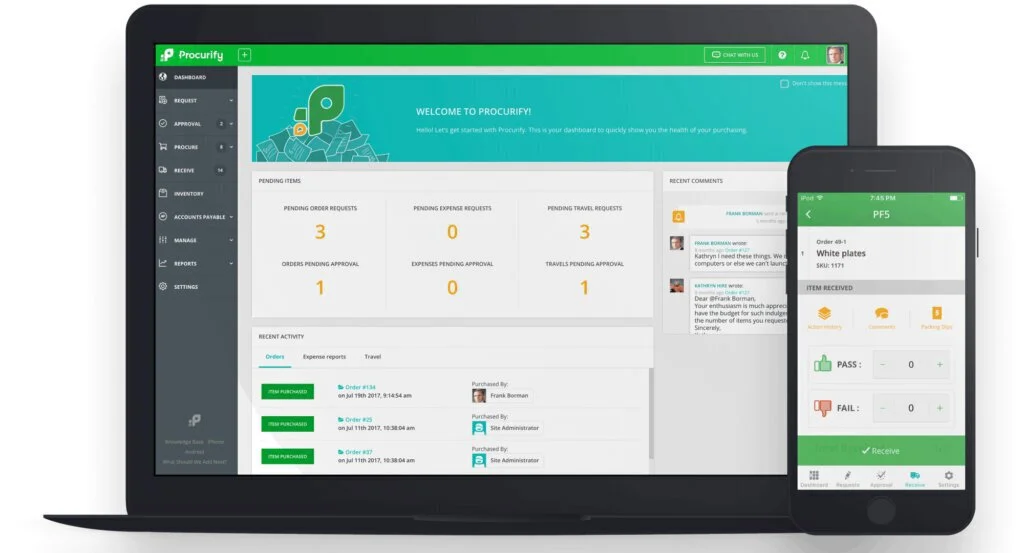

9. Procurify

Procurify is an online procurement solution created for enthusiastic and creative teams. Some advanced features and essential benefits are part of it to enhance management culture. It provides team members with different roles in the approval tasks to prevent all unauthorized activities. Work with it to make approval task thresholds and controls for all users from your teams and departments. You can adjust many approval levels according to company structure and organize the spend control.

A manager can view how each purchasing is affecting the team’s budget and send requests and approvals to multiple departments according to these measurements. You can manage the requirements of each user or team, make informed and quick decisions, and boost the quality of budgeting strategy. It stores and archives data in electronic records and provides a smart notifications system to avoid double billing.

Besides, you can make the best quality spend reports, search data through purchase data, and get detailed data insights. Procurify facilitates the user to produce and distribute purchase orders and fill relevant details automatically. This platform saves all purchase order records in a centralized location, accessing user to get or check data instantly. Budget analytic features help you to track and control spending activities and budgets. Plus, monitor current purchase orders, approvals, expenses, and requisitions as well as create and send purchase orders.

Features

- Approval routing

- Budget management

- Inventory

- Mobile approvals

- Order requisitions

- Budget tracking

Pros

- Expense filling

- Custom modules

- Vendor management

- Travel request

- Analytical reporting

- Budget tracking

Cons

- Limited integrations

Pricing

- Quote-based Plan: Contact vendor

Visit: Procurify

10. SAP Concur

SAP Concur is an expense and travel management program having the aims to help hotels to manage their bills, costs, and expenses. The four major components of SAP Concur are Concur Travel, Concur Expense, Concur for Mobile, and Concur Invoice. The program work as the official travel dynamics for small businesses and large corporations. It includes convenient tools to track, analyze, and create reports about travel spending.

It records expenses immediately and approves it by taking a snap of receipts. It creates electronic receipts of hotels, airlines, ground transportation services, and restaurants. It also integrates with resource planning information to provide complete details of your expenses and budget. Customized trip planning tasks facilitate managers to decline or approve request adjustments.

The program offers a large inventory of travel distribution systems like web-only fares and negotiated prices. Besides, it provides twenty-five report templates for your documentation. SAP Concur includes dynamic options to match your purchase and invoice workflows. It contains automated vendor payments like credit cards, ACH, and checks. A self-portal for suppliers helps them to check payments and invoices without any disturbance.

Features

- Supplier self-portal

- View of travel details

- Report attachments

- Online booking

- Smartphone apps

- Template reports

- Credit card integration

Pros

- A quick review of travel information

- Accounting integration

- ERP

Cons

- Works slow

Pricing

- Trial: Free

- Standard Edition: $8/report

- Professional Edition: By quote

Visit: SAP Concur

Final Words

Overall, these applications are providing the best solutions for accounts payable and business management. These applications perform automatically related to financial tasks, including accounts payable, accounts receivable, order management, cash management, and spend management. These applications offer multiple built-in report templates to make your balance sheets and other financial reports.

Work with these programs to track bills, invoices, and sales. Most of these programs are offering download versions for Windows, Mac, iOS, and Android users to work for their businesses from anywhere, anytime. Basic charts, dashboards, and graphs are present in these applications to analyze your business performance.