The finance department is an essential part of any organization or enterprise. Managing all accounts, billings, payments, bank deposits, and check receiving is part of the finance department. Organizations spend a lot of money on paperwork and employees for managing financial tasks.

However, they can eliminate these hurdles by performing all tasks online. Many online organizations are providing solutions for all these tasks.

What is Financial Management Software?

Many online management applications are providing tools for better financial management. These applications offer detailed analytics and reports related to economic issues, allowing professionals to make accurate decisions for future planning.

They can use these tools for budgeting and forecasting. They automate tasks related to billing, payments, bank accounts, and credit cards. Some systems are also offering mobile apps to increase their functionality.

Best Financial Management Software

Here is the list of Best Financial Management Software that is offering all features for better financial management.

1. Jenzabar One

Jenzabar One is an attractive financial management system that helps you to make your students happy and get your enrollment goals. It will assist you in identifying and giving financial aid awards to deserving students. It provides more accurate reporting and automation for smarter and faster financial aid services. Use a single platform to plan, create, manage, and strengthen relationships with constitutes.

The applications facilitate in finding prospective donors and engaging them using personalized and modernized communication methods. Use Jenzabar Retention to get unique insights into at-risk and successful students. The student information system is useful to collect data related to advising, registration, events, and student life.

Features

- Student Portal

- Enrollment

Pros

- Human Resources

- Retention

Cons

- Stops working sometimes

Pricing

- Demo: Free

- Pro: Contact the vendor

Visit: Jenzabar One

2. Oracle Financials Cloud

Oracle Financials Cloud is a scalable and integrated financial management platform created to help global organizations. They can work with it for reporting on new KPIs and automating expense. This multi-dimensional reporting system analyzes account balances, view them, and interact with account balances. You can automate imaging, control payments, invoices, and supplier balances, and manage cash forecasts, cash positions, and bank accounts.

Generate performance obligations, allocate revenue to performance obligations automatically, and accrue assets and liabilities for performance obligations. Apply for customer payments, generate customer invoices, recognize revenue, manage customer balances, and manage customer data centrally. Track bankrupt customers, improve cash flow, push work to collectors, and rank customers uniquely.

Features

- Manage expenses

- Accounting Hub

Pros

- Revenue management

- Payables and Assets

Cons

- Slow working

Pricing

- Trial: Free

- Enterprise: Ask the vendor

Visit: Oracle Financials Cloud

3. Kepion

Kepion is a flexible, fast, and easy CPM application that assists in business planning. It is using Microsoft Business Intelligent Platform for Kepion planning that facilitates you to integrate your budgeting, forecasting, and planning functions into a single platform. It helps accounting and finance teams to automate collecting data tasks and focus on making significant decisions. Microsoft

Business Intelligence Platform is there to offer collaborative and analytical tools for your business requirements. Create Kepion Dashboards and use tools for additional analysis and reporting. You can create apps for budgeting, forecasting, planning, analysis, and reporting requirements in minutes. Integrate this platform with Salesforce, SAP, Microsoft Dynamics CRM, Microsoft Dynamic AX, and Oracle.

Features

- Create apps

- Automate collecting data tasks

Pros

- Budgeting capabilities

- Self-service BI capabilities.

Cons

- Old user interface

Pricing

- Demo: Free

- Pro: Contact the vendor

Visit: Kepion

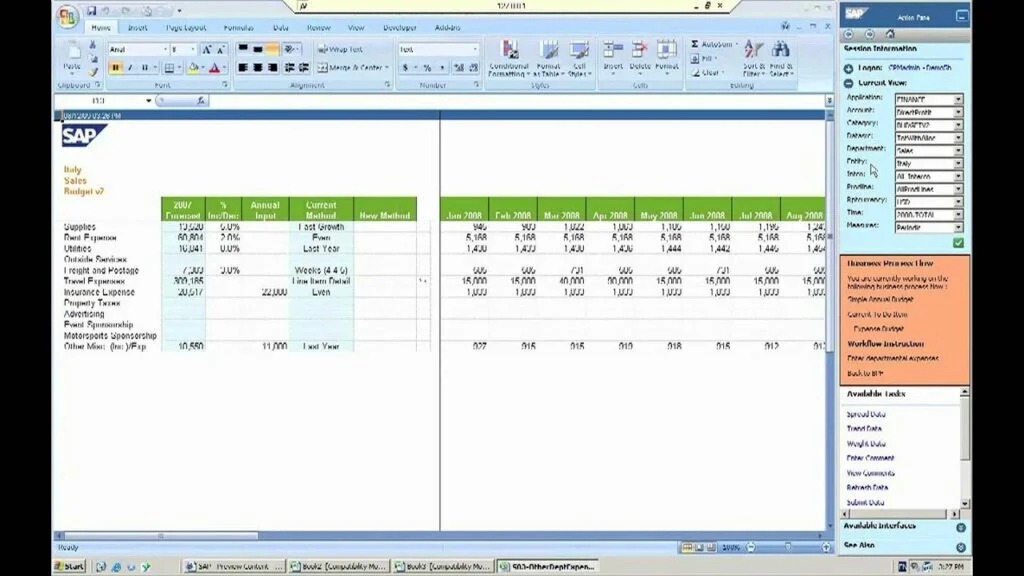

4. SAP BPC

SAP BPC is a business financial management application that provides augmented analytics and innovative planning. It streamlines your achieving and planning to grow your business in less time. You can boost your budget and closing cycles, adjust forecasts and plans, and get compliance with reporting standards. It offers real-time access to data and includes integration with SAP and non-SAP data. Work with collaboration features to enhance planning and accountability accuracy.

Align your plans with strategic goals, close the books faster, and shrink cycle times efficiently. You can create forecast models and adjust and update forecasts quickly. Use this platform for consolidation and business planning to reduce errors and save time. It performs allocations, aggregations, and other manual tasks automatically.

Features

- Legal and Management Consolidations

- Forecasting and Budgeting

Pros

- Built-in Financial Intelligence

- Unified Planning

Cons

- Complicated transactions

Pricing

- Trial: Free

- Pro: contact the vendor

Visit: SAP BPC

5. Unit4 Financials

Unit4 Financials is an accelerated financial management program that provides tools for better management of your organization. It offers real-time and flexible financial intelligence and complete insights into your business workflow. It is quite helpful for procurement management, billing management, financial management, and asset management.

The program can measure, analyze, and classify your business and make changes to get real-time financial details. Automate back-office tasks for gaining smarter workflows. You can interact with your systems to manage every job using natural language digital assistant. Use simple methods to optimize your governance and make smarter decisions for better management.

Features

- Natural language digital assistance

- Automate back-office tasks

Pros

- Reconfigurable tools

- Single Ledger

Cons

- Hard to get reports

Pricing

- Demo: Free

- Pro: Ask the vendor

Visit: Unit4 Financials

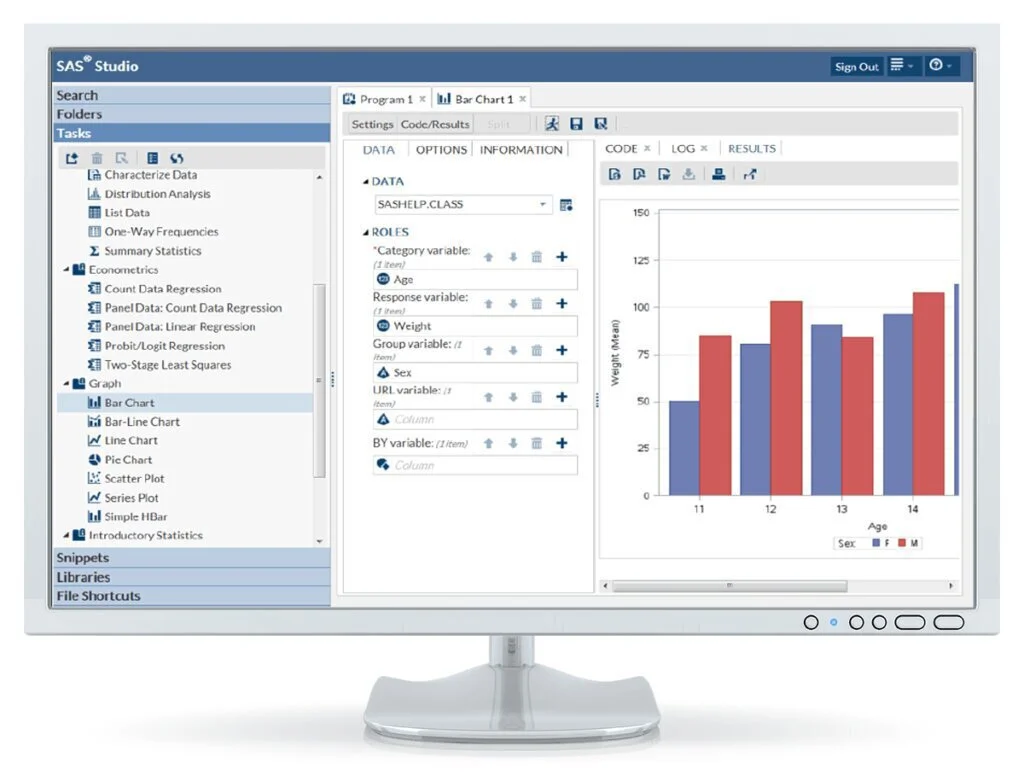

6. SAS Financial Management

It is an advanced platform to improve the timeliness and accuracy of finance. You can understand profitability, costs, and revenue and make more accurate budgets. It offers a single platform for consolidation, budgeting, reporting, planning, and reporting. Accounting logic and calculation engine facilitate you to consolidate historical and planning information on requirements.

Work with built-in dashboards and scorecards for seamless strategy communication. The process management framework allows people to automate critical tasks, generate and monitor the business process, and find and resolve bottlenecks. Perform on-demand consolidations like intercompany eliminations, allocations, automatic currency conversion, and ownership adjustments.

Features

- Create accurate forecasts

- Communicate strategy

Pros

- Publish financial reports

- Improve business process

Cons

- Complex architecture

Visit: SAS Financial Management

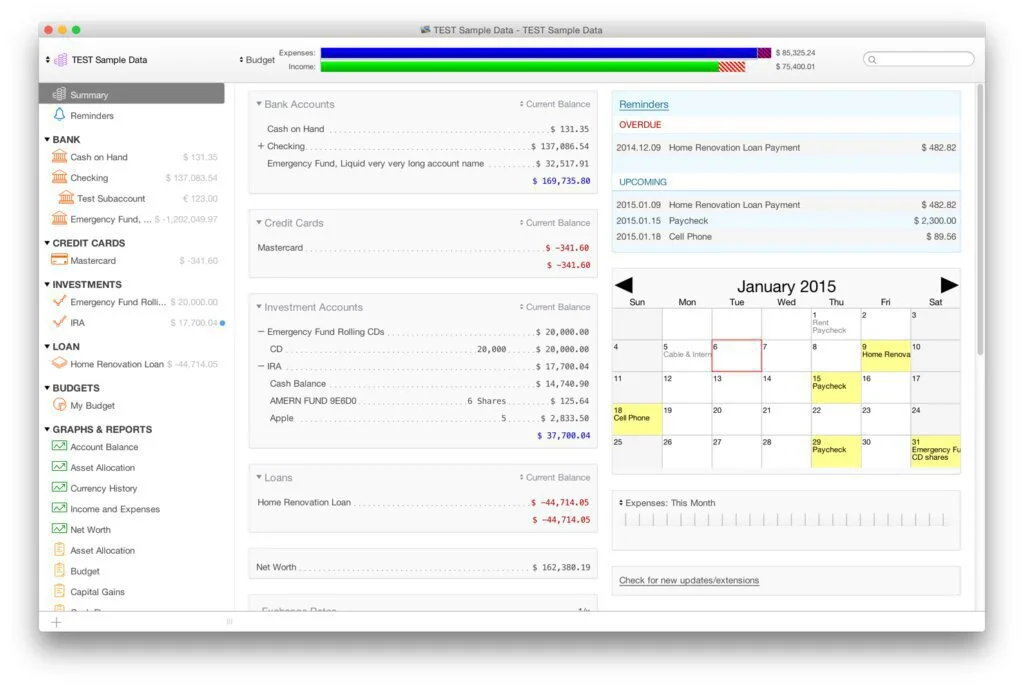

7. Moneydance

Moneydance is a personal finance management program that includes all tools you require, such as account management, online banking and bill payment, investment, and budgeting tracking. It can send payments online and download transactions automatically. Get a complete overview of your finances like reminders, overdue and upcoming deals, account balances, and exchange rate information. Use the transaction reminder tab for recording the transaction automatically.

Work with a graphical feature to create visual reports related to your expenses and income. For getting a personalized graph, you can set the date range, the graph type, and any specific setting. You can save the charts in PNG image files or print them. Besides, use the account register to insert, delete, or edit transactions in an account, and automate the sorting of transactions and calculation of balances.

Features

- Account register

- Graphs and reports

Pros

- Summary

- Online Banking

Cons

- Difficult to make entries

Pricing

- Pro: $49.99

Visit: Moneydance

8. Epicor ERP Financial Services

Epicor ERP Financial Services is a financial management web-based program that provides insightful global accounting. You can access real-time information and make faster and smarter decisions using analytics and reporting. Work with deep multicurrency, multi-company, and multibook support. Use integrated accounting and finance features to reduce back-office costs, plan smarter, and react smarter.

You can automate journal updates, price, and revenue allocations. Reporting and analytics tools managers for making informed decisions. Use Microsoft Excel to improve flexibility, collaboration, and automation. You can report to a C-level business leader, and create operational and financial business models. It offers prepared packages for CAPEX, Cash Flow, profitability, sales, and more.

Features

- Financial Budget Planning

- Reporting and Analytics

Pros

- Accounting and Finance

- Requisitions and Procurement

Cons

- Time-consuming to learn

Visit: Epicor ERP Financial Services

9. LucaNet Software

LucaNet Software is offering every financial solution for your requirements. It saves all processes related to finance and accounting into a single database. It can manage tasks related to financial planning, preparing financial statements, reporting, and analysis. You can get complete information about figures in real-time, data for prior periods, and forecasted financial details.

The application offers BI and Analytics, ESEF and disclosure management reporting, and management reporting. Work with it for forecasting and scenario planning, budgeting and financial planning, and group control. Control all your financial processes and get a historic view of financial data. Automate the significant tasks and enhance the efficiency of your work.

Features

- Maximum certainty

- Detailed analysis

Pros

- Harmonized corporate management

- Maximum automation

Cons

- Need enhancements

Visit: LucaNet Software

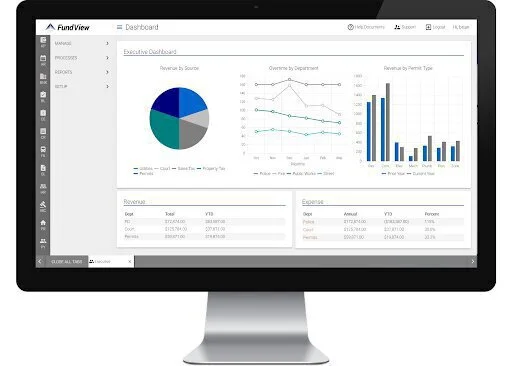

10. FundView Financial Suite

FundView Financial Suite is a state of the art solution for financial management. It reduces your recurring annual software costs and initial investment. The program backups and updates the data automatically to reduce IT spending. Dashboards have Word/Excel integration for image/documents attachment. You can better serve your citizens and streamline processes.

It offers many professional services for successful implementation. Maximize productivity, simplifying the process, and manage tasks with minimal disruption. It provides cost-effective training to professionals like interactive live sessions, remote training, and distance learning environment. It has a cloud-hosted and secure environment to save and manage your working data.

Features

- Conversion

- Training

Pros

- Support

- Data backup

Cons

- NO utility bills

Visit: FundView Financial Suite

The Verdict

Overall, these top ten financial management programs are offering accounting and finance solutions for managers. They can get financial details, accounting information, previous history, and information about figures.

They can control their business tasks and prepare financial reporting. These tools are helpful for group controlling, budgeting, accounts planning, forecasting, are scenario planning. Get automation, flexibility, and collaboration to boost up business.