Online Banking is the part of the extensive Banking system where all products and services related to the bank are provided online. Nowadays, the banking system is shifting from traditional to digital banking.

Online banking includes web-based services and high levels of process automation. Banks allow customers to work with their mobile applications to perform their financial tasks, relieving the burden of services on their employees.

What is Online Banking Software

Many online platforms on the Internet are providing their services to Banks to manage their financial and transaction tasks. These platforms are known as Online Banking Software.

These programs manage all current and future processes of a bank, connect different branches of a bank and boost their functionality. They use a single server for storing all information of a bank and allow branches to access data from the server.

Best Online Banking Software

Here is the list of Best Online Banking Software that includes high standard tools for digital banking.

1. BnC

BnC is a web-based banking software that has extensive experience implementation, development, and maintenance and includes Artificial Intelligence or Digital Intelligence. The program provides analytics services on new cumulation, aggregation, and delivery. It is using the latest technology to convert data into digital format.

Banks can provide enhanced customer service and help them in time. It provides a centralized environment using the Centralized Online Real-Time Exchange (CBS). It stores customers’ information in a central server, and all branches of a bank can access data from there. It helps banks to boost the efficiency of the workflows, deliver services faster and automate workflows.

Features

- Cloud-Based Systems

- Automate tasks

Pros

- Customer services

- Central Server

Cons

- Client alerts limitations

Pricing

- Starts: $100,000

Visit: BnC

2. Bankingly

Bankingly is a digital banking program that is offering financial solutions to banks and other institutions. It helps your customers to interact with you using Mobile banking apps for Android and iOS. The program provides multiple channels to communicate with your customers. Your clients or customers can get their products by accessing the system from any PC or tablet.

You can perform tasks according to your requirements and enables your customers to make transactions instantly. It offers secure and agile digital banking channels to provide safe working experience. They enhance, update, and develop the system continuously to create a current working environment. Use digital channels of this platform to interact with customers effectively.

Features

- Future-proof

- Top security

Pros

- Short Time to Market

- Pay Per Real Use

Cons

- Need improvements

Pricing

- Demo: Free

- Enterprise: Contact the vendor

Visit: Bankingly

3. Mobile Money

Mobile Money is providing financial freedom to people anywhere in the world. It is giving mobile payment solutions to commercial service organizations and their clients. This platform is offering a secure method for people to save money and pay bills for services and goods. It connects large companies like food vendors and big-box retailers with their customers through mobile apps.

It offers multiple tools like bill payments, person-to-person money transfer, cash-out withdrawals, and cash-in deposits. The system also includes group to person and business to person bulk disbursements. The program offers a trusted method to transfer money from one account to another. Work with it for online payments, business-to-business payments, and person-to-merchant payments.

Features

- Online payments

- Bill payments

Pros

- Secure transactions

- Cashout withdrawals

Cons

- No App for PC users

Visit: Mobile Money

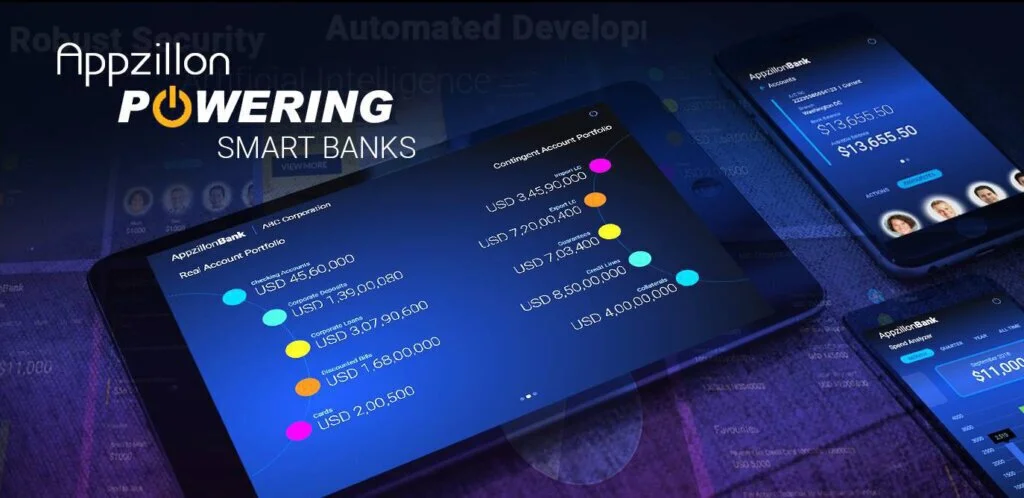

4. Appzillon

Appzillon is a digital banking platform that helps banks to redefine their experiences. This program has aims to deliver convenient, personalized, and relevant services and products to your customers. This platform provides realistic results, boost productivity, and enhance functionality. Banks are using this digital program for rapid digital transformation.

It offers digital banking experience to both staff and customers of a bank. The program provides help in corporate banking, consumer banking, corporate onboarding, a digital branch, relationship management, agency banking, and consumer onboarding. Key features of this tool are rich functionality, robust security, personalized experience, and multi-experience support.

Features

- Agile and Flexible

- Robust Security

Pros

- Platform Driven

- Personalized Experience

Cons

- Need enhancements in customer care

Pricing

- Professional: Contact the vendor

Visit: Appzillon

5. Kony Digital Banking Platform

Kony Digital Banking Platform is the next generation digital banking system to accelerate the digital roadmap of banks and credit unions. It provides native, pre-built web apps to offer a frictionless digital experience to customers. Extendable architecture and APS helps banks to expand their services and products.

The program uses customer outcomes for their analytics to drive upsell, enhance customer outcomes, and boost profitability. You can control roadmap and bring specific initiatives and products to markets for better results. Work with client services tools for collections, ticketing, and recovery. You can communicate with your customers using a browser-based portal to increase marketing and customer retention.

Features

- Robo-Advisor

- Client Servicing

Pros

- Customer Retention

- Marketing

Cons

- Poor documentation

Pricing

- Trial: Free

- Pro: Ask the vendor

Visit: Kony Digital Banking Platform

6. Kapowai Online Banking

Kapowai Online Banking is an advanced banking solution with high-level security. It includes a multi-functional remote banking system that facilitates individuals, entrepreneurs, and customers to perform banking tasks quickly, securely and in real-time. A personal finance manager assists customers to plan and manage their finance individually.

A personalized interface helps professionals to add, hide, configure, and change the order of functional elements and information in the system. Mobile banking is including biometric technologies such as Fingerprint for Android and Face ID and Touch ID. Siri personal assistant is there to provide information about the current amount, current balance, and date of loan payment

Features

- Self-service Systems

- Custom Software development

Pros

- Internet Banking

- Mobile Banking

Cons

- Simple interface

Pricing

- Pro: Get a quote

Visit: Kapowai Online Banking

7. Arttha

Arttha is offering a digital banking solution to redefine your business. The program provides services across all devices to save development costs. It engages customers in a better way for their financial tasks. Work with built-in and reusable components for fast deployments. The program combines standard and global platforms with local variations.

The program is offering services related to real-time interaction, new revenue streams, cost optimization, and personalized customer experience. Use this open banking system for generating quick business value and facilitating digital transformation. Besides, it offers a multi-lingual mobile app, single interface, card services, and self-registration with paperless onboarding.

Features

- Multiple integrations

- Multi-lingual mobile app

Pros

- Self-registration

- Cardless ATM withdrawals

Cons

- Need more features

Pricing

- Pro: Get a quote

Visit: Arttha

8. FusionBanking Essence Online

FusionBanking Essence Online is providing componentized and open structure for the banking system. It can fulfill the all requirements of a bank like an end to end lending, payments, deposits support and current savings, pricing, and fee capabilities and provides flexible general leader platform. This platform helps in decreasing operating costs, increasing sales conversion, boosting up margins, and making better overall profitability.

It has integration with Fusion Risk to provide timely and accurate agile risk assessments and reporting. Banks and their clients will get a successful and smooth journey across digital and physical touchpoints. You can deliver compelling services and products to customers using preferred channels.

Features

- Full compliance

- Smarter digital banking

Pros

- Full compliance

- Innovation and Deployment

Cons

- Many advertisements

Pricing

- Pro: Contact the provider

Visit: FusionBanking Essence Online

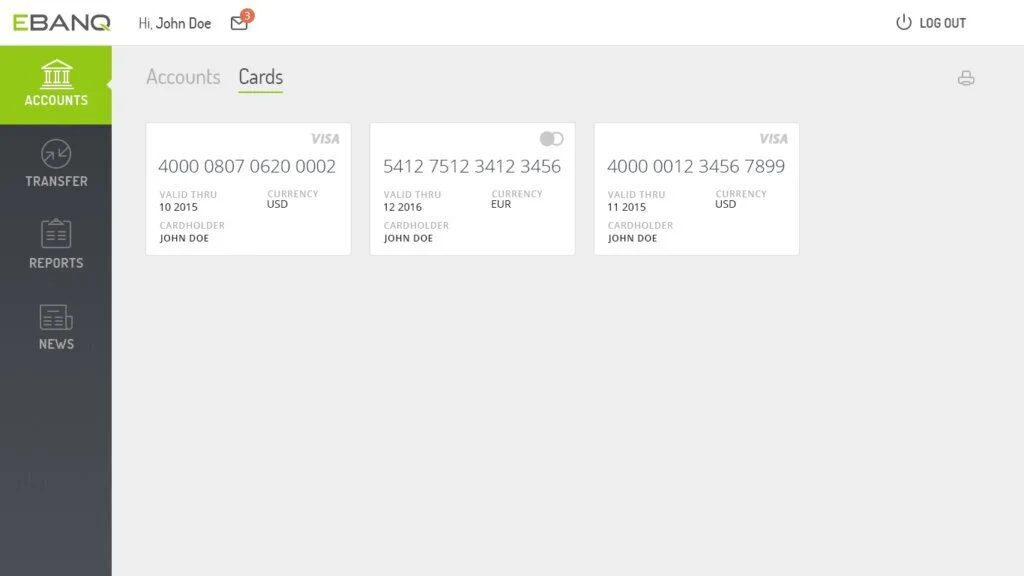

9. EBANQ

EBANQ is providing a fully customizable application for your digital banking system. It is an excellent platform for helping payment institutions, electronic money institutions, asset managers, remittance companies, and cryptocurrency exchanges. Its banking app works fast with all primary browsers and loads quickly on all devices.

You can customize this platform by adding your logo, changing icons and colors and provide a better look according to your environment. The program includes microservices, state of the art cloud technology, and modular architecture. The program supports many administrator accounts having numerous permissions and roles. It configures all relevant transaction fees in the admin settings.

Features

- Support multiple currencies

- Cross-currency transactions

Pros

- Cryptocurrencies

- API architecture

Cons

- Basic features

Pricing

- Demo: Free

- Professional: Call the vendor

Visit: EBANQ

10. Digital Banking Solution

Digital Banking Solution is a fast and advanced banking application to provide next-generation solutions to finance organizations. The program includes Home banking, Open banking, Facebook banking, WhatsApp banking, and mobile banking. It consists of the Business Process Manager and Customer Relations Manager for better help.

Besides, this tool gives a robust and secure DBS Integration Layer. This digital platform offers all tools of core banking like Account and Invoicing, Cards, Recoveries, IFRS, and Credits. Work with a large number of financial services like investment and commercial. Additionally, you can get consulting, system architecture, business intelligence, and digital channels for communication with customers.

Features

- Core banking

- Digital channels

Pros

- Account and Finance

- System Architecture

Cons

- Need enhancements

Pricing

- Professional: Contact the vendor

Visit: Digital Banking Solution

Conclusion

Overall, these online banking solutions want to provide advanced services to banks for managing their regular tasks. All of these applications are offering mobile apps for the customers to perform their transactions from their mobiles.

They can send money and payments, make transactions, and buy services and products online. These applications have a secure and robust system to keep a record of all documentation, analytics, and reports.