The claim of payment by a business for service rendered or goods supplied that clients have ordered but still not paid are known as Accounts receivable. Claims are in the form of invoices created by an enterprise and sent to the client for payment within a time interval. They are shown as an asset in a balance sheet. Account receivable is part of the accounting transactions to deal with the invoices of a client or customer for his order services and goods.

Most of the time, a company provides the flexibility of time to the client likely, 30, 60, or 90 days. After paying these bills, these are known as accounts payable. Nowadays, most of the large organizations are doing their businesses online and offer millions of products and services to their customers online.

Customers or clients get these services or products by visiting on the websites, and after that, they receive billing invoices for these products. Customers can pay these invoices through their bank accounts or credit cards. These companies organize these invoices in spreadsheets to keep records of accounts.

What is Accounts Receivable Software?

Creating invoices and send these invoices to customers or clients is quite a difficult task, and it takes a lot of time for professionals. For such purpose, several solutions are present in the market that can perform invoicing tasks automatically. Such solutions are known as Accounts Receivable applications. These cloud-based solutions provide integration with multiple bank accounts so customers can pay bills using their bank accounts or credit cards.

Most of these programs are offering mobile apps for iOS and Android users so that they can submit invoices instantly without using personal computers. These applications provide many invoices templates to save time and offer customization options regarding logo and color. So professionals can customize and forward unlimited invoices. They can track and update invoice status and can accept credit card payments online.

Best Accounts Receivable Software

It is the list of best Accounts Receivable Software that is providing the best invoices services to small to large organizations.

1. FreshBooks

FreshBooks is one of the best cloud solutions for small organizations. It is famous for streamlining the time tracking process and client invoicing. Its mobile apps can manage your business when you are away from the office. You can control expenses, send invoices, communicate with clients, take snaps of receipts, and sync data on all your devices. Plus, you can make a billing schedule and send invoices in currencies according to your client preference.

Features are customizable, enabling you to trigger notifications, attach files, and assign expenses, track billing, and set alerts for delayed payments. A tool to manage billing history is part of it to keep track of current and past invoices. The program can control transactions, enabling the user to manage accounts with MasterCard, Google Checkout, Visa, Amex, or work with PayPal.

An online payment gateway is there for cloud invoicing to collect installments without talking about problems with the client. Customers can pay bills in local currency using a multi-currency invoicing. Keep track of expenses by attaching and organizing receipts in the program. You can import the costs from your bank directly by linking this solution with your credit card or bank account. Bank accounts reconciliation and non-invoice income recording are the most advanced features of this program.

Features

- Online payments

- Estimates

- Get paid with deposits

- Quick accounts

- Customize invoices

Pros

- Client credit

- Offline payments tracking

- Invoice preview

- Quick bank deposits

- Balance sheet

- Accounts aging

Cons

- Limited users

- Advanced features are missing

Pricing

- Trial: Free

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

Visit: FreshBooks

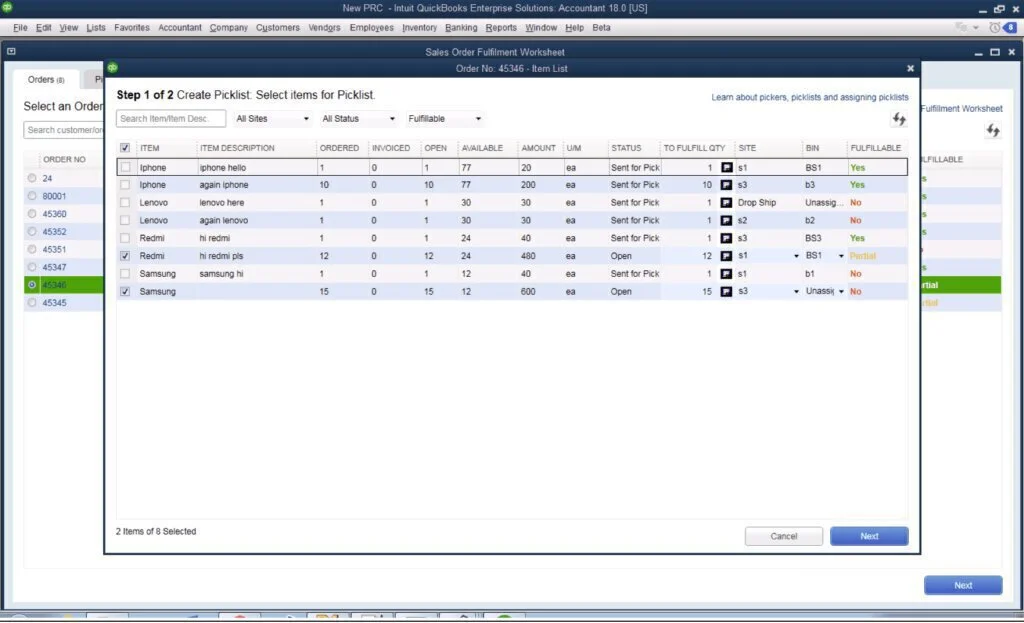

2. QuickBooks Enterprise

QuickBooks Enterprise is a cloud-based accounts managing program to solve all problems related to accounts. It is offering comprehensive accounting features to serve you well. It works as Income Tracker to provide a complete view of all transactions related to income. You can make transactions from numerous accounts and banks in one place. You can access report templates made by other QuickBook users, as well as can work with more than 138 standard reports like Average Customer Days to Pay, Profit and Loss, Statement of Cash Flows, and many more.

You can create custom reports and export data to a new Excel spreadsheet. Take snapshots of sales, order, re-orders, purchased, and other on-hand items. It keeps track of your inventory and enables you to check your inventory requirements with an inventory stock status report. Work with payroll tools to streamline the payroll process and print federal and state forms, or employee management forms.

You can get vendor information, add or edit different vendors, make and send orders, and make timesheets for numerous vendors or employees in one batch. Get a price level list to add 750 different prices, add or edit customers, send invoices, sales orders, and estimates. You can calculate sales tax, apply for payments, and manage various customer addresses.

Features

- Advanced inventory

- Accounting

- Payroll

- Advanced permissions

- Accountant center

- Payroll and Employees

Pros

- Scheduling

- Mobile payment and billing

- Quantity discounts

- Finances and reports

Cons

- For large organizations only

Pricing

- Trial: Free

- Silver Plan (With Hosting): $140/month

- Gold Plan (With Hosting): $169/month

- Platinum Plan (With Hosting): $198/month

- Silver Plan (Local Only): $1155/year

- Gold Plan (Local Only): $1502/year

- Platinum Plan (Local Only): $1848/year

Visit: QuickBooks Enterprise

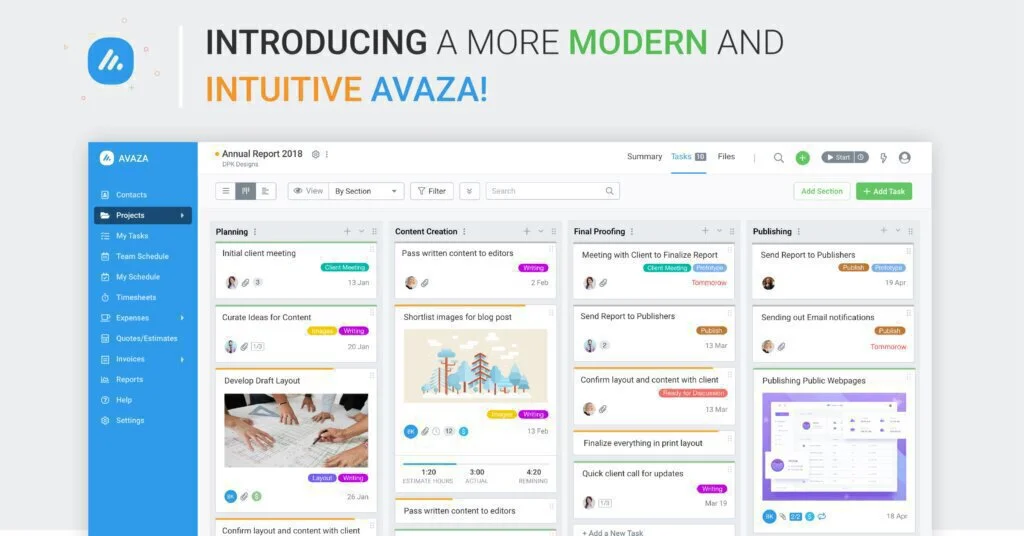

3. Avaza

Avaza is a cloud-based management program to run projects successfully. It is helpful for online invoicing, project collaboration, expenses management, and time tracking. A broad range of integrations is part of it to extend its functionality. You can set up recurring tasks, invoices, expenses, and give reminders to team members. Plus, it allows to set up integrations with over 500 applications to crate task automatically.

The attractive interface provides a list view of tasks and Kanban view to streamline your workflow. Billing and Invoicing feature enable you to accept online payments and send professional-looking invoices quickly. Reporting tools are there to track receivable, understand your revenue, and review customer transactions. A multi-currency expense tracking and credit note functionality is also part of it.

The program offers support to split payments across invoices, create project charts, and project management. Cloud management is part of it and provides tools for billing and expense management. It offers tools for multi-currency expenses payments, credit notes, and invoicing. The program is compatible with tablets and smartphones, and you can access it online without downloading it.

Features

- Business reporting

- Credit notes

- Collaboration

- File sharing

- Project budgeting

Pros

- Project management

- Online payments

- Task management

- Time tracking

Cons

- Scheduling is little clumsy

Pricing

- Trial: Free

- Startup: $9.95/month

- Basic: $19.95/month

- Business: $39.95/month

Visit: Avaza

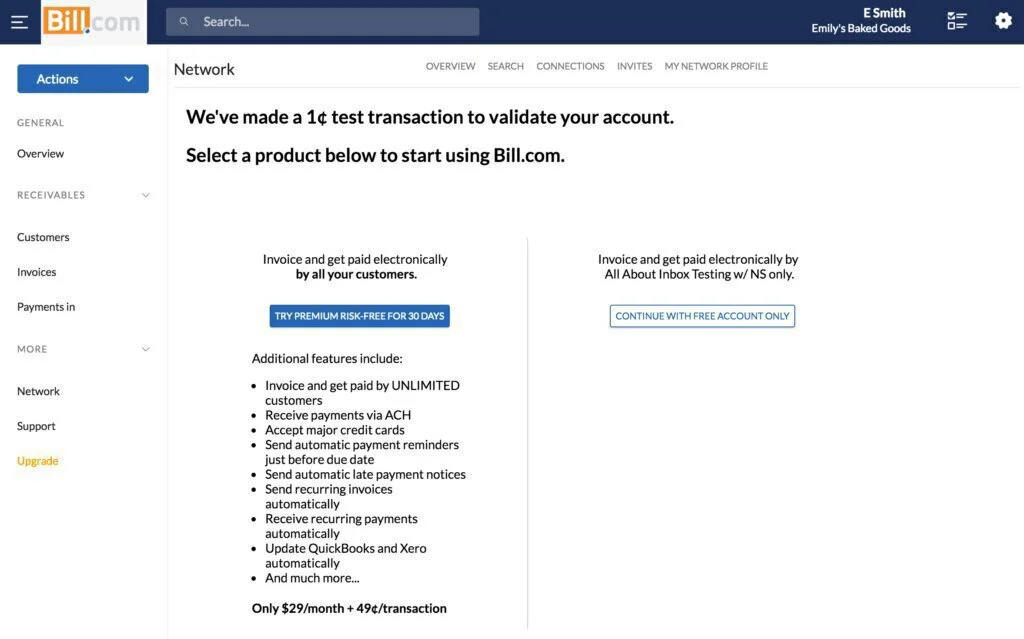

4. Bill.com

Bill.com is one of the popular digital business payments companies to provide simple A/R and A/P solutions. It is offering unlimited document storage, simple online bill payment, and custom invoicing services. It is efficient for small to medium businesses for workflow collaboration. Its services sync to user’s bank accounts and accounting software to manage company financials in a better way.

Bill.com is the best application for uniting banks, businesses, and accountants for fast payments networks. This cloud-based system assists customers via its efficient accountant channels, getting together documents, people, and systems to make business payments in a better way. It is helping more than 600,000 network members in payments every year and save 50% of their time on back-office operations.

Top 100 accounting firms and then U.S banks are working with Bill.com for their payment requirements. This program has won 40 awards for the best performance in the account management field. You can pay vendors via check, ACH, or PayPal, and synchronize data on multiple devices. It provides unlimited document storage and helps you to email reminders and personalized invoices.

Features

- Record payments

- Cash flow management

- Fraud protection

- Accounts receivable

Pros

- Schedule bills

- Document storage

- Pay vendors through multiple accounts

Cons

- Limited invoicing features

- Poor customer support

Pricing

- Trial: Free

- Essential Plan: $29/user/month

- Team Plan: $39/user/month

- Corporate Plan: $59/user/month

- Enterprise Plan: By quote

Visit: Bill.com

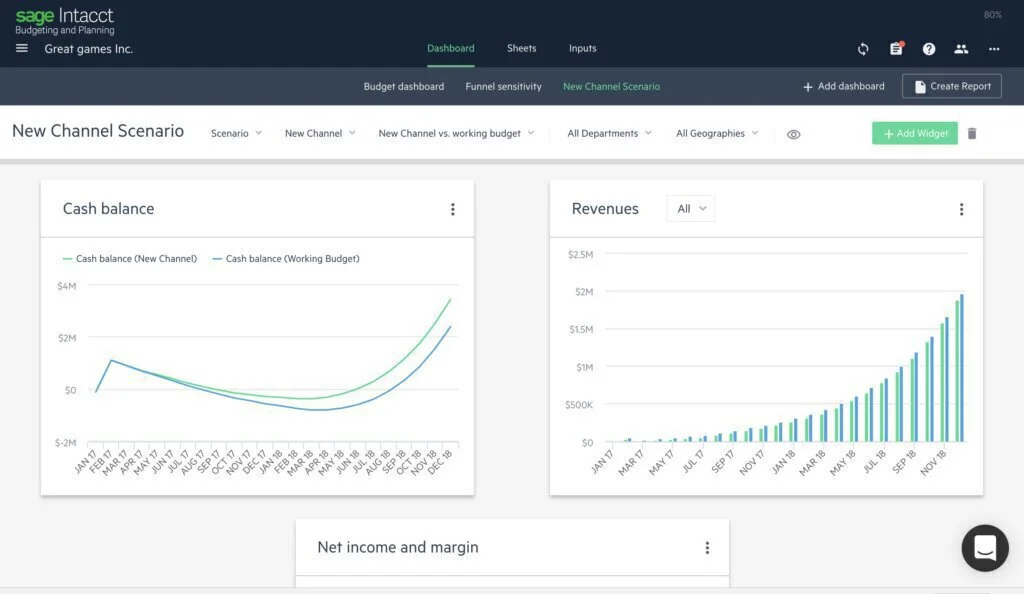

5. Sage Intacct

Sage Intacct is providing an intuitive solution for financial management. The program also offers optional features with additional costs. Smooth data entry is part of it to provide financial reports with minimum errors. It provides maximum control over basic margins and expenses and provides multi-currency management features. You can set sales tax automation for streamline compliance. Built-in reports templates are part of it, and you can use balance sheets to track sales and analyze performance.

Besides, you can simplify reporting according to the requirements of a presentation. It contains various basic charts, graphs, and dashboards, relevant to basic financial reports. An admin can set and customize calculations to compute for commissions and KPIs. It can monitor payment transactions to make the process transparent. Key security features provide limited control to individuals, roles, projects, and groups.

This solution can work adequately with e-commerce websites for online services and purchases with a secure platform. Multiple templates are there for the simple processes to save users’ time. The default dashboard is useful for experienced persons. Plus, you can customize the Dashboard and make shortcuts of typical functions. The user can work with only the required programs and can eliminate time-wasting systems to boost productivity.

Features

- Accounts receivable

- Multiple currencies

- Accounts payable

- Sales tax

- Auto-tax calculator

Pros

- Bank reconciliation

- Trial balance

- Automated journal entries

- Inventory management

Cons

- Clunky interface

Pricing

- Trial: Free

- Quote-based Plan: Contact vendor

Visit: Sage Intacct

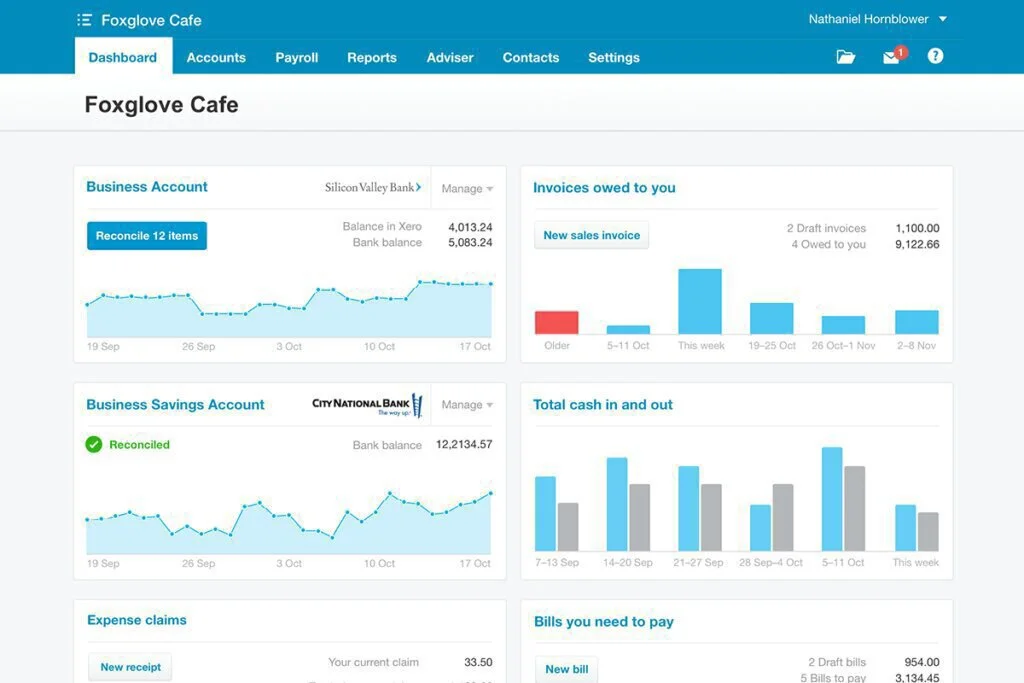

6. Xero

Xero is a cloud-based financial collaboration application to meet the requirements of small businesses. The program includes only top rank features for significant accounting gaps. From the Dashboard of Xero, you can compare finances in dynamic charts and monitor the company’s billing. Besides, get all action sections for your financial management. Seven tabs are there, and in the Settings tabs, you can adjust economic settings and insert corporate information.

From the accounts menu, search and change checks, expense claims, and bank accounts as well as make records for payroll requirements. The user can edit all purchase files, and work with the ready templates to skip time taking drafting. Two-factor authentication and the multiple-approval modal can minimize the option of financial fraud. It is offering a complete list of performed actions for every transaction, including users, dates, and manual notes.

You can control purchase orders and make categories of invoices like awaiting approval, drafted, delayed, or awaiting payment. It includes standard reports like Income Statements, Balance sheets, and Cash Flow records. It can process and run payrolls and adjust taxes for over 20 states automatically. A payroll performer can create and keep records to use in your transactions. All these records include details like purchase costs, tax status, relative descriptions, and committed quotes.

Features

- Expense claims

- Dashboard

- Bank reconciliation

- Expense claims

- Multiple currencies

Pros

- Inventory

- Payroll

- Purchase orders

- GST returns

- Fixed assets

Cons

- Poor customer care

Pricing

- Trial: Free

- Starter: $9/month

- Standard: $30/month

- Premium 10: $70/month

Visit: Xero

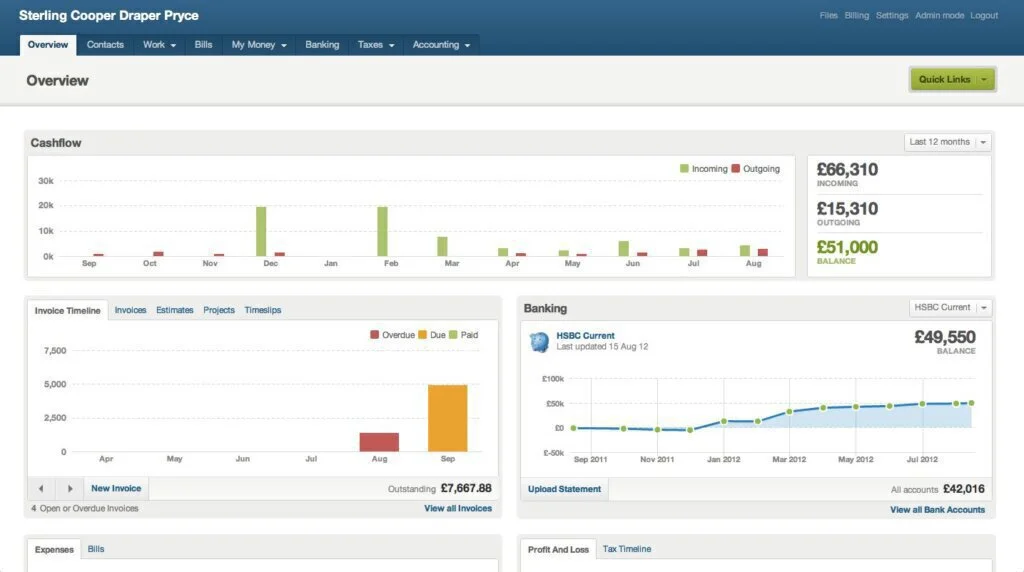

7. FreeAgent

FreeAgent is an efficient online tool for small businesses and freelancers. It assists managers in managing all types of financial operations, from managing expenses to running payrolls. Timesheets and built-in stopwatch are there to keep time records. From the Dashboard, you can monitor Cash Flows and connect bank accounts to import transactions to the system automatically.

It offers finance officers a complete overview of organization expenses, income, receivables, and profitability to perform fast operations. The program has 26 integrations like Stripe, Paypal, Zapier, and Receipt Bank. It is an efficient system to manage invoicing and books. It can perform a large number of payment operations, keep professionals on top, and assists them the understand the value of their business transactions.

You can associate the program with your bank accounts and insert and remove 3rd party integrations instantly. The Dashboard can show graphs and charts to provide business activities. Professionals can view expenses and timeslips, cash flow, invoices as well as losses and profits. Eight invoice templates are part of it to create and send invoices. The user can set reminders and recurring, and customize invoice numbering according to contacts and projects.

Features

- Customize invoices

- Invoice templates

- Send proposals and estimates

- Send recurring invoices

Pros

- Multiple currencies

- Balance sheets

- Configure sales taxes

- Tax reports

- Easy invoicing

- Expense management

Cons

- Limited reports

- No payroll

Pricing

- Trial: Free

- Universal Plan: $10/mo for six months

Visit: FreeAgent

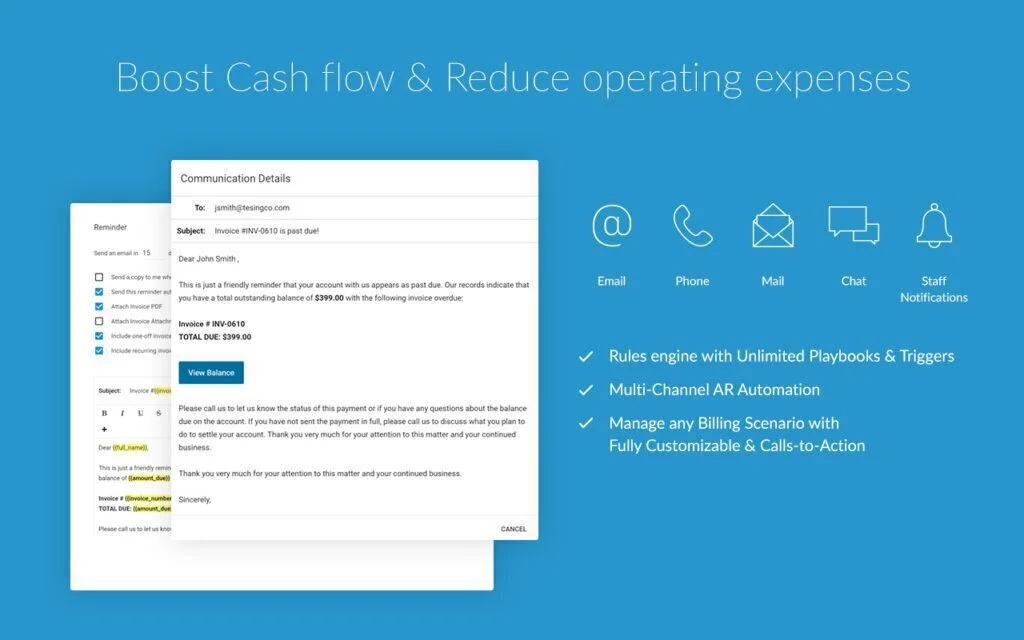

8. Armatic

Armatic is an application solution for payment and billing management. The program offers a solution for billing and invoicing, subscription management, and payment processing. An AR module gets together payment interfaces, processes, and best practices under a single roof. It has integration with external ERP solutions to perform the process of Accounts Receivable. Customer portals enable users to get self-help options like changing subscription plans and viewing invoices.

They can get ERP integration, automated invoicing, and multiple customer support functions with their portal. It includes a module for Accounts Payable workflows, bill payment options, and approval rules to automate the process. It has integration with leading ERP provides and gives a vendor portal with bill payment and invoice viewing options. It can create invoices automatically using proposals and quotes and can connect via API.

The program offers customization options and templates for SOWs, quotes, proposals, and contracts, including customer data. It has integration with template editor and quote-to-cash engine and enables managers to see real-time reports and status updates. Its Customer Success Module collects feedback and offers clients with a complete view of their customers with feedback components and customer health scores. The document and eSign management tools are helpful for document signing processes.

Features

- Invoices

- Subscriptions

- AR Automation

- AP Automation

- Payments

- Proposals and Quotes

Pros

- eSign

- Documents

- Employee NPS

- Reminders and Tasks

- Customer NPS

Cons

- Limited control over quote forms

Pricing

- Trial: Free

- Standard: $25

- Plus: $45

- Pro: $65

Visit: Armatic

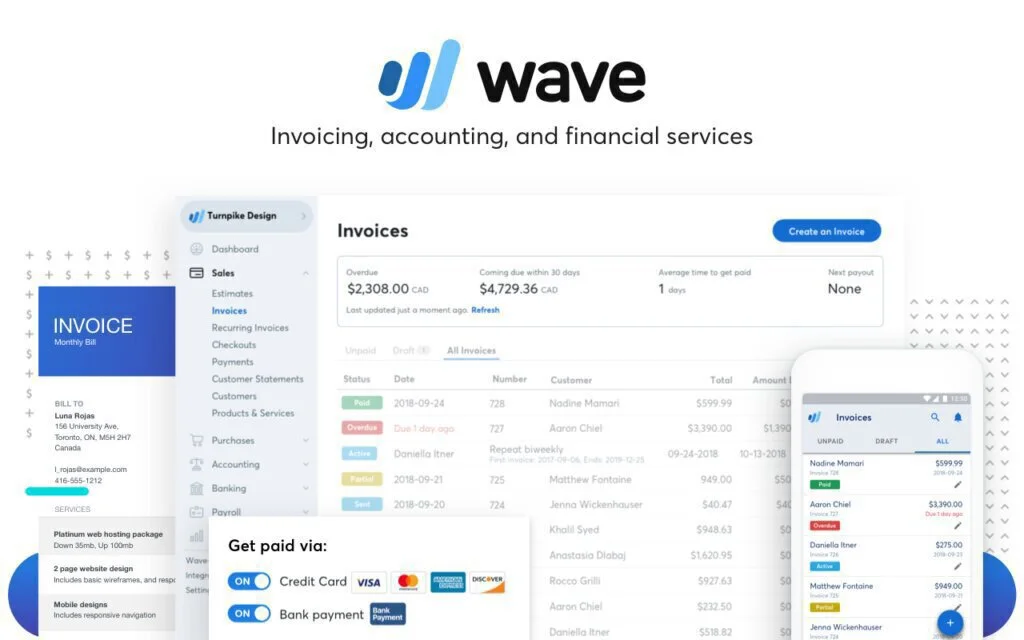

9. Wave

Wave is an award-winning program designed to assists entrepreneurs in financial problems. It provides a complete image of financial success. It helps you to understand and manage expenses and income. You can connect to other Wave tools like invoicing, payroll, and payments. It tracks everything and performs every task automatically. The program allows the user to create and send professional invoices and work with advanced tools like automatic payments and recurring billing.

It includes read-only bank data connections and works with 256-bit encryption. For repeated customers, it set up recurring invoices and perform credit card payments automatically. You can switch between manual and automatic billing. It syncs all your payment and invoicing information automatically using a free accounting app. It provides free Android and iOS apps to send invoices whenever you need them.

It shows invoices as become due, viewed, or get paid. Work with invoice reminders to email your customers automatically. You can customize invoices using logos and colors and make perfect invoices with customizable columns. Keep track of overdue invoices, payments, and partial payments. It accepts bank payments, and credit cards get paid automatically.

Features

- Multiple currencies

- iOS and Android apps

- Send estimates

- Accept credit cards

- Personalize invoices

- Cash flow insights

Pros

- Sales tax calculations automate

- Add colors and logos

- Backup

- Track payments

- Accounting integration

Cons

- Unsuited for large businesses

- Poor customer support

Visit: Wave

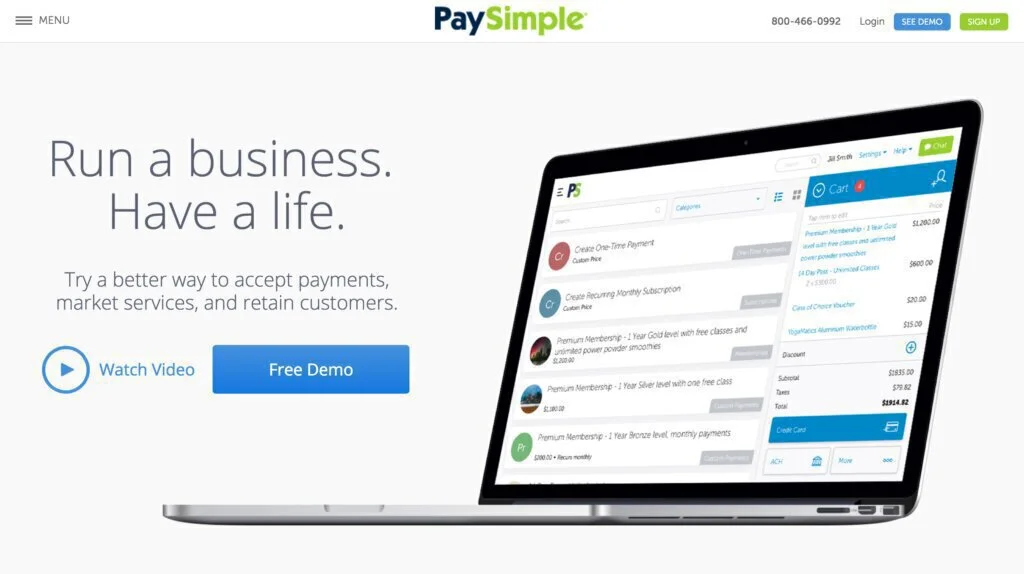

10. PaySimple

PaySimple is a cloud-based receivable automation service specially designed for small organizations. The Dashboard gives a complete overview of the business’s billing, like overdue, paid, and pending invoices. The user can keep an eye on customers and their pertinent details, including banking and credit card information, to boost up future transactions. He can create invoices, add products, services, and customers, and save details for future use.

Professionals can manage their customer relations, collect and process payments, and create invoices. They can accept debit cards, ACH e-checks, and credit cards, making comfort for their clients to use the preferred mode of payment. With the online booking tool of PaySimple, the user can create more business and get more chances by demonstrating his staff and services.

Working with the Calendar tool to manage time effectively. Besides, he can set lead times, block personal time, and see all the appointments of you and your staff in a single calendar. To boost up the payment task, allow customers to log in to a portal where you can send emails to them and settle their payments. Send reminders and follow-ups to your clients automatically as well as reschedule or cancel appointments.

Features

- Create invoices

- Collect payment

- Accept credit cards

- Booking tool

Pros

- Calendar app

- Follow-ups and reminders

- Reschedule appointments

Cons

- Not good for big organizations

- Pricing

- Trial: Free

- Pro Plan: $49.95

- Enterprise Plan: $99.95/month

Visit: PaySimple

The Verdict

Most of the above cloud-based programs are award-winning invoice management applications to provide the best services to customers. These applications help to create spreadsheets of invoices. Dashboards of these programs offer a complete view of your project process and billing information. Customers can pay using a check, ACH, PayPal, and other methods.

You can set reminders and email personalized invoices to your customers as well as keep track of customers and suppliers. Most of these programs can work like inventory management and offer support for multiple currencies. Some also provide customer management and can schedule unlimited recurring billing. Professionals can track time by clients and projects as well as insert and categorize expenses. Besides, they can work on multiple devices like mobile, tablet, and computer.